Rental car companies can be quick to offer insurance on your rented vehicle, but is it really necessary?

TRICOR Insurance has created a 12 point checklist intended to help you understand the protections provided by your personal auto policy*.

No one plans to have a house or apartment fire. There is no advance warning like with a snow or thunder storm. So what can you do to be prepared?

No one plans to have a house or apartment fire. There is no advance warning like with a snow or thunder storm. So what can you do to be prepared?

One of the most used phrases we hear as an insurance agent is “my house is not worth that much!”

It can be very confusing: market value, actual cash value, assessed value, and replacement reconstruction cost and guaranteed replacement cost. Which one is right? The answer is: it depends.

Did you know you can save money on your home insurance if you have recently updated your roof, furnace, electrical or plumbing?

Did you know you can save money on your home insurance if you have recently updated your roof, furnace, electrical or plumbing?

Most companies will require proof of the improvements, such as receipts for shingles or other supplies.

As the leaves start changing color and the weather starts cooling down, it can only mean one thing; fall is here. When we think of fall, pumpkins, sweaters and corn mazes all come to mind. And with so many activities and so little time, it’s easy to forget that fall is a time to be thankful. With the holidays approaching, there is no better time than now to start getting into the holiday spirit!

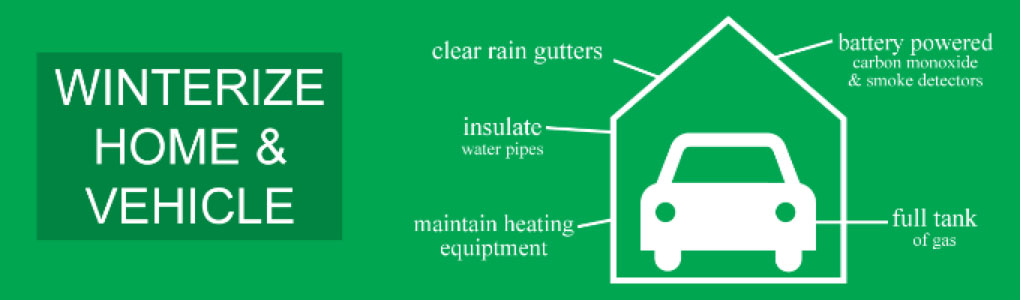

Winterize Your Home and Vehicle

We can’t always avoid winter storms, but we can take precautions to be prepared for the unexpected and recover with as little damage as possible. Things such as winterizing your home and vehicle are some of the best ways to reduce damage.

For home or rental property owners, freezing pipes are a big concern during the cold winter months. The pipes most at risk are exposed pipes in unheated areas of the home, pipes located on exterior walls, and any plumbing on the exterior of the home. Here are our top fours tips for making sure your pipes won’t freeze this winter.

Workers compensation can be a large expense for small businesses. It’s not uncommon for small business owners, especially new business owners, to exclude themselves from coverage on their own company’s workers’ compensation policy to reduce the expense. The assumption is that their health insurance will cover any injuries they suffer while working. The truth is that most health insurance policies do not cover work related injuries. The benefit for lost wages provided by a workers compensation policy is often overlooked during this cost/benefit analysis. Most disability policies also exclude work related disability as well. Can you afford to go without health insurance and disability insurance when you are most at risk?

Unlike some life insurance pricing variables that are out of your control, such as your age or gender, blood pressure is a factor that lifestyle choices can positively impact. Even if high blood pressure runs in your family, a healthy lifestyle can keep yours in check and lower your insurance rates! One of the best steps you can take is limiting foods loaded with sodium, which has a particularly negative impact on blood pressure.

In the Midwest there are two things that nearly everyone loves about summer—enjoying the warm weather and grilling. In fact, July is peak grilling season followed closely by May, June and August. I’m sure we all can agree there’s nothing better than the smell of food like burgers, salmon and ribs cooking on a grill.

Spooky skeletons, carved pumpkins, high-tech LED lights and broomstick-riding witches are sure signs that Halloween is on its way. While Halloween is full of fun festivities, it is still important to prepare your property for this night to avoid insurance claims and lawsuits. Here are some tips to protect your home and ensure safety:

The saying, “April showers bring May flowers” is true, especially to us in the Midwest. Spring storms like thunderstorms, heavy rain, hail and tornadoes are inevitable and often times unpredictable. When severe weather strikes with little notice the risk of injury to yourself and damages to your property greatly increases. Here are some helpful tips to help protect you, loved ones and property during the next ‘April shower.’

The saying, “April showers bring May flowers” is true, especially to us in the Midwest. Spring storms like thunderstorms, heavy rain, hail and tornadoes are inevitable and often times unpredictable. When severe weather strikes with little notice the risk of injury to yourself and damages to your property greatly increases. Here are some helpful tips to help protect you, loved ones and property during the next ‘April shower.’

With just a couple of weeks left to go, now is the time to start thinking about some year-end tax moves you can make. We have some ideas for you to think about before the year is over.

The holiday season is a time for family and friends to get together. That also means there is an increase risk to fire. We’ve pulled together few simple steps to help ensure a fire-safe holiday season.

Would you ever drive the length of a football field at 55 mph blindfolded? Well that’s essentially what you’re doing when texting while driving. According to the National Highway Traffic Safety Administration, texting behind the wheel takes a driver’s eye off the road for an average of 4.6 seconds, which is the time it takes to go from one end zone to the other. Dangerous? Incredibly. Deadly? You bet.

Texting while driving has now replaced drinking and driving as the leading cause of death among teenage drivers.

A common insurance question is “how is my car protected if it’s in the shop?” If you carry physical damage coverage (often referred to as comprehensive and collision) your vehicle is still covered under your policy when it’s in the care, custody or control of the auto repair or body shop.

A common insurance question is “how is my car protected if it’s in the shop?” If you carry physical damage coverage (often referred to as comprehensive and collision) your vehicle is still covered under your policy when it’s in the care, custody or control of the auto repair or body shop.

When you insure an automobile, boat, or recreational vehicle, your agent will ask you if you want comprehensive and/or collision coverage. Do you know what you are agreeing to, or declining?

When you insure an automobile, boat, or recreational vehicle, your agent will ask you if you want comprehensive and/or collision coverage. Do you know what you are agreeing to, or declining?

Comprehensive coverage includes covering claims from wind, hail, fire, theft, vandalism, animal strikes and glass breakage. It’s the things you have no control over. The exception to that rule is hit and run. Hit and run is considered a collision loss.

You aren’t thinking about insurance as you get ready to travel, but you should be. Take a moment and think—are all the belongings I have either in my car or being towed covered? The answer is maybe.

Car collecting is a passion!

Your passion could be everything from vintage, classic, customized or even some of the rarest automobiles in the country. It’s a hobby, and everlasting passion. We’re as passionate about your car as you are.

Millions of students are headed back to school this fall. It’s a good time to educate yourself and drivers alike on the rules of the road around school buses and in school zones, the dangers of distracted driving and how to keep pedestrians safe.

As soon as they start learning to drive, whether your teen is starting with a learner’s permit or going straight to the license, you should inform your insurance company to have them added to your policy. This is usually much more cost-effective than placing them on their own policy, especially if you are a safe driver with a clean record. They will also be eligible for more coverage under your policy.

Every year we try to start off the New Year by making resolutions that we hope to accomplish in the year to come. Usually when we hear “New Year’s Resolutions,” we think to lose weight, eat healthier and get more sleep. And while those are great goals, we came up with a few that will not only improve your life but possibly your insurance expenses as well.

Understanding your homeowners insurance is important—it’s one of the biggest investments you’ll make throughout your life. Understanding your options on the types of coverage options you have for homeowners insurance will help you make informed decisions.

Let’s break down the difference between actual cash value and replacement cost options. Coverage options you choose are uniquely based on your tolerance to risk and your overall financial well-being.