MADISON, WI – July 14, 2023 — TRICOR Insurance is pleased to announce that our very own Ryan Von Haden has been named one of the 2023 Top Retail Brokers by Insurance Business America. This prestigious award is a testament to Ryan’s insurance expertise, dedication, and commitment to excellence in specialized areas of the commercial insurance industry.

Investment to support the company's growth acceleration strategy

Lancaster, WI November 8, 2021 TRICOR Insurance, a leading nationwide business insurance, employee benefits, personal insurance, and individual life and health independent insurance agency, announced today that J.C. Flowers & Co., LLC (J.C. Flowers), a leading private investment firm dedicated to investing globally in the financial services industry, has made a strategic investment in the company. Terms of the transaction were not disclosed

TRICOR Insurance is honored to have been named Agency of the Month by The Rough Notes Company for October 2021.

The Rough Notes Company is a trusted magazine publisher that has been serving the insurance industry since 1878, which is why we are so honored to be recognized by them. Now, TRICOR Insurance will join the ranks of those eligible to become The Rough Notes Company’s choice for Agency of the Year 2021.

No one plans to have a house or apartment fire. There is no advance warning like with a snow or thunder storm. So what can you do to be prepared?

No one plans to have a house or apartment fire. There is no advance warning like with a snow or thunder storm. So what can you do to be prepared?

One of the most used phrases we hear as an insurance agent is “my house is not worth that much!”

It can be very confusing: market value, actual cash value, assessed value, and replacement reconstruction cost and guaranteed replacement cost. Which one is right? The answer is: it depends.

Did you know you can save money on your home insurance if you have recently updated your roof, furnace, electrical or plumbing?

Did you know you can save money on your home insurance if you have recently updated your roof, furnace, electrical or plumbing?

Most companies will require proof of the improvements, such as receipts for shingles or other supplies.

As the leaves start changing color and the weather starts cooling down, it can only mean one thing; fall is here. When we think of fall, pumpkins, sweaters and corn mazes all come to mind. And with so many activities and so little time, it’s easy to forget that fall is a time to be thankful. With the holidays approaching, there is no better time than now to start getting into the holiday spirit!

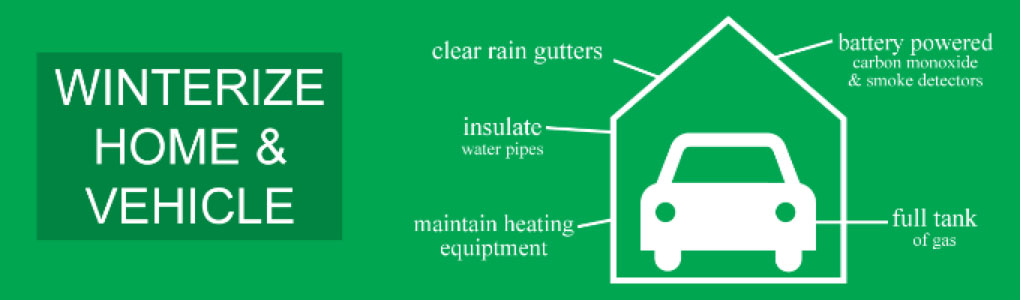

Winterize Your Home and Vehicle

We can’t always avoid winter storms, but we can take precautions to be prepared for the unexpected and recover with as little damage as possible. Things such as winterizing your home and vehicle are some of the best ways to reduce damage.

For home or rental property owners, freezing pipes are a big concern during the cold winter months. The pipes most at risk are exposed pipes in unheated areas of the home, pipes located on exterior walls, and any plumbing on the exterior of the home. Here are our top fours tips for making sure your pipes won’t freeze this winter.

Workers compensation can be a large expense for small businesses. It’s not uncommon for small business owners, especially new business owners, to exclude themselves from coverage on their own company’s workers’ compensation policy to reduce the expense. The assumption is that their health insurance will cover any injuries they suffer while working. The truth is that most health insurance policies do not cover work related injuries. The benefit for lost wages provided by a workers compensation policy is often overlooked during this cost/benefit analysis. Most disability policies also exclude work related disability as well. Can you afford to go without health insurance and disability insurance when you are most at risk?

To most people, when they hear the word “audit” they immediately have unpleasant thoughts and want to throw out both hands and scream “NOOOOO”. Many people associate audits with taxes and the big, bad IRS and usually nothing good can come from this experience. But not all audits are bad!

Every construction site needs a Severe Weather preparedness plan to ensure a safe environment during hazardous weather. Having a written Emergency Action Plan (EAP) is also an OSHA requirement.

Every construction site needs a Severe Weather preparedness plan to ensure a safe environment during hazardous weather. Having a written Emergency Action Plan (EAP) is also an OSHA requirement.

In the Midwest there are two things that nearly everyone loves about summer—enjoying the warm weather and grilling. In fact, July is peak grilling season followed closely by May, June and August. I’m sure we all can agree there’s nothing better than the smell of food like burgers, salmon and ribs cooking on a grill.

One of the smartest decisions a company can make is ensuring that their work space is safe. Workplace safety is extremely important for many reasons. When implemented correctly, it has the ability to create a more productive work environment, lower absenteeism, and boost profit margins. Most importantly, when a company has a safe workplace, their most valuable asset is protected – its people.

Spooky skeletons, carved pumpkins, high-tech LED lights and broomstick-riding witches are sure signs that Halloween is on its way. While Halloween is full of fun festivities, it is still important to prepare your property for this night to avoid insurance claims and lawsuits. Here are some tips to protect your home and ensure safety:

The old proverb says, “Don’t cry over spilled milk.” While it’s certainly a waste of time and energy to cry over it, you should take spills very seriously—especially those in the workplace. Whether you spill milk, coffee, oil or chemicals, any kind of workplace spill can lead to serious problems or injuries. Not only could your workers slip and fall, but they may also be exposed to dangerous substances and fumes.

The old proverb says, “Don’t cry over spilled milk.” While it’s certainly a waste of time and energy to cry over it, you should take spills very seriously—especially those in the workplace. Whether you spill milk, coffee, oil or chemicals, any kind of workplace spill can lead to serious problems or injuries. Not only could your workers slip and fall, but they may also be exposed to dangerous substances and fumes.

The saying, “April showers bring May flowers” is true, especially to us in the Midwest. Spring storms like thunderstorms, heavy rain, hail and tornadoes are inevitable and often times unpredictable. When severe weather strikes with little notice the risk of injury to yourself and damages to your property greatly increases. Here are some helpful tips to help protect you, loved ones and property during the next ‘April shower.’

The saying, “April showers bring May flowers” is true, especially to us in the Midwest. Spring storms like thunderstorms, heavy rain, hail and tornadoes are inevitable and often times unpredictable. When severe weather strikes with little notice the risk of injury to yourself and damages to your property greatly increases. Here are some helpful tips to help protect you, loved ones and property during the next ‘April shower.’

A common insurance question is “how is my car protected if it’s in the shop?” If you carry physical damage coverage (often referred to as comprehensive and collision) your vehicle is still covered under your policy when it’s in the care, custody or control of the auto repair or body shop.

A common insurance question is “how is my car protected if it’s in the shop?” If you carry physical damage coverage (often referred to as comprehensive and collision) your vehicle is still covered under your policy when it’s in the care, custody or control of the auto repair or body shop.

With all of the beauty that winter brings, it consequently brings hazards as well. During winter months, parking lot hazards increase due to dropping temperatures, snow, ice, and less daylight. Unfortunately, if accidents do happen on your property, you could be liable.

With all of the beauty that winter brings, it consequently brings hazards as well. During winter months, parking lot hazards increase due to dropping temperatures, snow, ice, and less daylight. Unfortunately, if accidents do happen on your property, you could be liable.

Every year we try to start off the New Year by making resolutions that we hope to accomplish in the year to come. Usually when we hear “New Year’s Resolutions,” we think to lose weight, eat healthier and get more sleep. And while those are great goals, we came up with a few that will not only improve your life but possibly your insurance expenses as well.

As soon as they start learning to drive, whether your teen is starting with a learner’s permit or going straight to the license, you should inform your insurance company to have them added to your policy. This is usually much more cost-effective than placing them on their own policy, especially if you are a safe driver with a clean record. They will also be eligible for more coverage under your policy.

Millions of students are headed back to school this fall. It’s a good time to educate yourself and drivers alike on the rules of the road around school buses and in school zones, the dangers of distracted driving and how to keep pedestrians safe.

Car collecting is a passion!

Your passion could be everything from vintage, classic, customized or even some of the rarest automobiles in the country. It’s a hobby, and everlasting passion. We’re as passionate about your car as you are.

You aren’t thinking about insurance as you get ready to travel, but you should be. Take a moment and think—are all the belongings I have either in my car or being towed covered? The answer is maybe.

Rental car companies can be quick to offer insurance on your rented vehicle, but is it really necessary?

TRICOR Insurance has created a 12 point checklist intended to help you understand the protections provided by your personal auto policy*.

When you insure an automobile, boat, or recreational vehicle, your agent will ask you if you want comprehensive and/or collision coverage. Do you know what you are agreeing to, or declining?

When you insure an automobile, boat, or recreational vehicle, your agent will ask you if you want comprehensive and/or collision coverage. Do you know what you are agreeing to, or declining?

Comprehensive coverage includes covering claims from wind, hail, fire, theft, vandalism, animal strikes and glass breakage. It’s the things you have no control over. The exception to that rule is hit and run. Hit and run is considered a collision loss.

Understanding your homeowners insurance is important—it’s one of the biggest investments you’ll make throughout your life. Understanding your options on the types of coverage options you have for homeowners insurance will help you make informed decisions.

Let’s break down the difference between actual cash value and replacement cost options. Coverage options you choose are uniquely based on your tolerance to risk and your overall financial well-being.

When it comes to cyber threats, many business owners, both large and small, are a target. Unfortunately, too many business owners take the approach that it’ll never happen to them or that their company isn’t big enough.

With the recent influx of news stories about serious data breaches, it’s not just the bottom line that gets impacted after a data breach. Brand image, which can have lasting revenue impacts, can also be compromised.

While hacks affecting the largest businesses are often reported in the news, hackers can target any size business. The U.S. Department of Homeland Security reports that 31% of all cyber-attacks are directed at businesses with less than 250 employees.

Would you ever drive the length of a football field at 55 mph blindfolded? Well that’s essentially what you’re doing when texting while driving. According to the National Highway Traffic Safety Administration, texting behind the wheel takes a driver’s eye off the road for an average of 4.6 seconds, which is the time it takes to go from one end zone to the other. Dangerous? Incredibly. Deadly? You bet.

Texting while driving has now replaced drinking and driving as the leading cause of death among teenage drivers.

At TRICOR Insurance, our Employee Benefits team is continually looking for ways to protect our employer benefits clients’ health and financial well-being. As health care costs continue to rise for employers, so has the demand for voluntary benefits like Short and Long Term Disability Insurance, Vision Coverage, and Long-term Care Coverage. Because many employers find a robust benefit package too costly, Voluntary Benefits have become an ideal solution, allowing employers to offer comprehensive “a la carte” benefits that are attractive to employees without added cost to the company.

We’ve seen it. We’ve certainly heard it before. Perhaps some of your employees have thought of it. “If only I could get hurt, or better yet, fake an injury, to collect workers compensation and not have to actually work.” What a leisured, stress-free life that would be, right!?

Administrating a Group Health plan comes with required notices and documentation that can be difficult to keep up with. The annual Medicare Part D Disclosure Notice is a prime example of the complexities employers can easily forget or possibly may not even be aware of.

As part of our value-added services, TRICOR Insurance reminds our clients around the details to complete the requirements of this two-part mandate: employee notification and CMS online disclosure.

The holiday season is a time for family and friends to get together. That also means there is an increase risk to fire. We’ve pulled together few simple steps to help ensure a fire-safe holiday season.

With just a couple of weeks left to go, now is the time to start thinking about some year-end tax moves you can make. We have some ideas for you to think about before the year is over.